We are compensated by lenders and third parties. We do not charge you for the service we provide and are not a representative or agent of any lender or a third-party provider. There is no guarantee that you will be approved for any type of loan. This website shall not be considered an offer or solicitation for a loan.

For those consumers who do not qualify for a personal loan, we will refer you to alternative lenders and providers. This website merely takes information from consumers and forwards it to lenders and third parties who may be able to provide the types of loans that may meet the consumers’ needs. The operator of this website is neither a lender nor a broker and does not make any credit decisions. We also favored establishments that offer personal loans with an APR between 0% and 15%, online loan application ability and a mobile app.ĭisclaimer: The purpose of this website is to connect potential borrowers with the lenders and financial service providers that advertise on this website. We gave weight to personal loan options between $2,000 and $50,000 with a turnaround time between 1 and 5 business days.

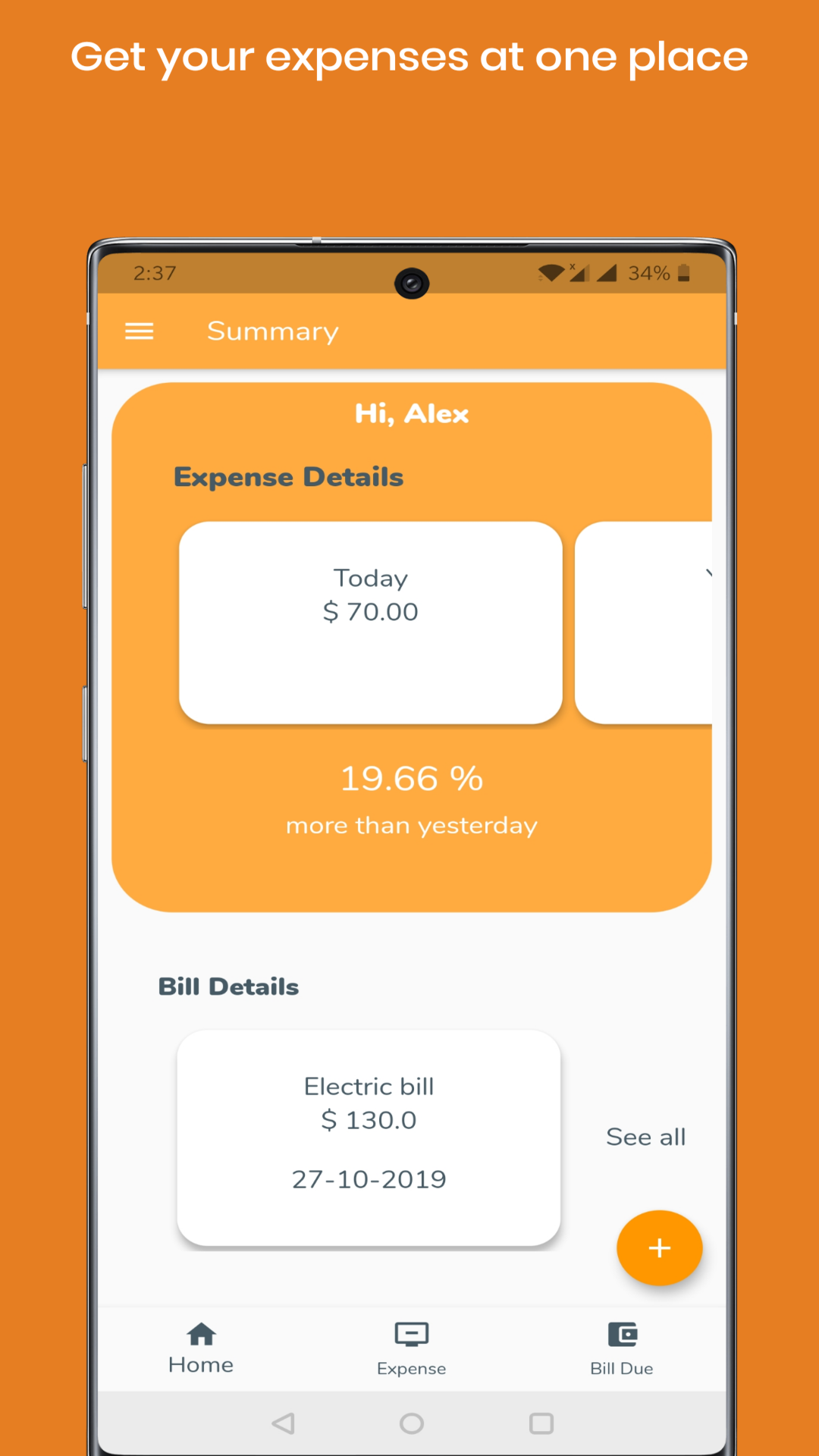

Methodology: To determine the best personal loans, Benzinga analyzed over 300 banks, credit unions and financial institutions. Take an in-depth look at several that we like and choose the one that best meets your needs. There are several expense tracker apps that can help you achieve your financial goals, from saving money for a new house or a vacation to getting out of debt or raising your credit score. Using state-of-the-art security measures, like 256-bit SSL end-to-end encryption and multifactor authentication and Touch ID, they keep your accounts safe and secure. Protect Your Financial DataĪll the best expense tracker apps make the protection of your financial data a top priority. Alerts help you stay on top of your bills and credit score and let you know when you start to go over a set limit in a spending category. You get personalized tips and advice for maximizing your money. Your transactions are synthesized into insights you can act on to stay on track with an expense tracker app. Keep All Your Money in One PlaceĪll your money in one place and linked to your smartphone allows you 24/7 access to your credit card and bank account balances and transactions, due dates for bills, monthly payments and spending and saving goals so you can manage your money from wherever you happen to be.

Here are some of the things to look for in order to get your finances back on track. The best expense tracker apps offer a list of features that help you manage your whole financial life in the palm of your hand, from the linking of your accounts to your smartphone to make sure your data is safe and protected. The sooner you can get out of debt, pay off your credit cards and consistently pay your bills on time, the sooner you will raise your credit score. Heavy debt loads and not paying your bills on time also negatively affect your credit score. A low credit score will result in higher interest rates on your credit cards and higher insurance payments. FICO ® scores are used by 90% of top lenders to make billions of credit-related decisions every year.Įach FICO® score is based on information that three credit bureaus, Equifax, TransUnion and Experian, keep on file about you. The best expense tracker apps are designed to help you get out of debt and improve your credit score. Reduce Your Debt and Raise Your Credit Score This makes it easier to stay aware of your goals and stick to your budget. Once you’ve set up a budget (you can do this easily with a budget app) an expense tracking app will help you monitor your spending with alerts to remind you of upcoming bill payments or to let you know when you’ve exceeded your limit in a spending category. Help You Create and Stick to a BudgetĪrmed with a new understanding of where your money is going and what kind of spending issues hold you back, you can create a budget and make choices about where and how you want to spend your money going forward. Once you see the whole picture, you can start making adjustments that will lead to a more secure financial future. It also lets you know what you’re spending it on and why you’re making certain choices, especially ones that put your finances in the red. It lets you know how much money comes in and goes out, where and when you spend your money. One of the most important things an expense tracker does is give you insight into your spending habits. Features of a Great Expense Tracker AppĪn expense tracker app links all your accounts to your smartphone so you can use the app’s features to manage your finances, get out of debt, pay your bills, raise your credit score, save money and achieve your goals.

0 kommentar(er)

0 kommentar(er)